Looking ahead to 2024 and our expectations for the television industry, Tom Buono, founder and CEO of BIA, keynotes a business forecast session at the TVB Forward Conference taking place Thu, Sept. 21, 2023.

In his presentation, Tom discusses the drivers behind the advertising forecast for television, which include heavy political advertising spending along with increased spending in key television verticals such as auto and legal. He also drills into expected growth for key media channels: TV over-the-air, TV Digital and CTV/OTT.

Offering overall business insights, Tom shares insights from BIA’s new Share of Wallet (SoW) Performance Benchmarking Analysis to examine local televisions’ share of the total advertising and identify concerns, strengths and opportunities.

Top takeaways from the presentation can be read in the following announcement.

—————-

BIA Estimates Local Broadcast TV Ad Revenues to Top $23.8 Billion in 2024, Bolstered by Political and Increased Auto and Legal Ad Spending

CHANTILLY, Va. (September 21, 2023) – BIA Advisory Services estimates the local broadcast TV industry in 2024 will generate $23.8 billion in advertising revenue, with $21.7 billion in over-the-air (OTA) revenue and $2.1 billion in digital television. This estimate indicates an 11 percent increase over 2023 for the television industry.

“We all expect a large number for local television ad spending in 2024, but it’s not only political that the industry can look to for growth,” said Buono. “Our new Share of Wallet (SoW) Performance Benchmarking Analysis reveals legal and automobile advertising will be up next year, too, providing solid opportunities for the industry. Beyond spending, we can see from this analysis how well television is performing across business verticals as compared to other media and in relation to the many advertising spend opportunities within a local market. Looking at ad spend this way is key to helping television continue to play to its strengths and find ways to take share from other media and move against threats.”

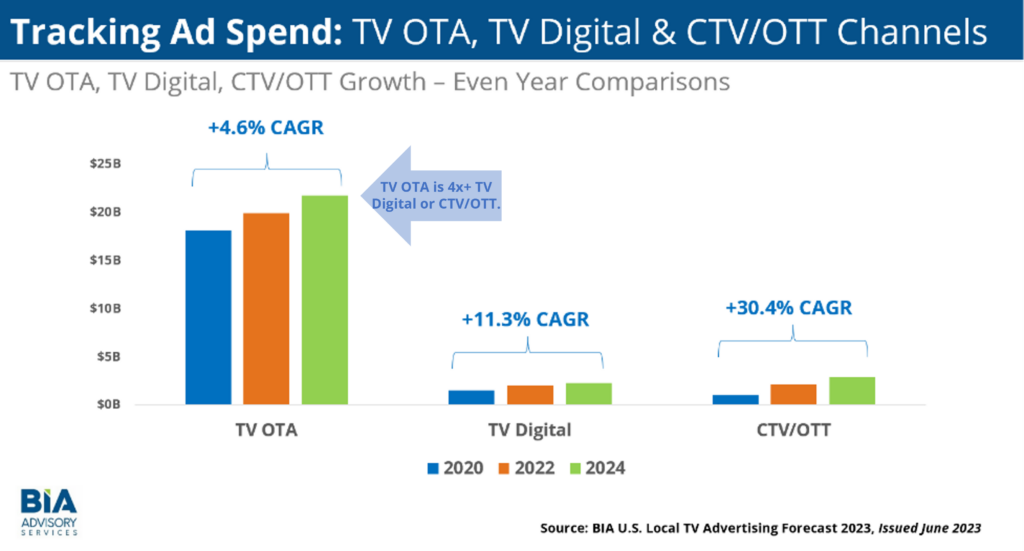

For automobile advertising, BIA’s 2024 forecast shows that TV OTA is expected to increase to $192.6 million in 2024, which will be the largest year-to-year increase since 2019. Another strong vertical for television in BIA’s SoW Performance Benchmarking analysis is legal services. BIA estimates legal spending will total $8.6 billion in 2024. When looking at ad share across all traditional media, TV OTA will be the only channel to grow for legal advertising in 2024. Buono also examined ad spend in the connected TV and over-the-top (CTV/OTT) category compared to OTA and digital. While smaller in dollars spent, CTV/OTT is the fastest growing platform in the past five years, with +30.4% CAGR (2020 to 2024). However, TV OTA has more than four times the ad spend, mainly driven by political, than the other two channels.

“After a few challenging years related to the pandemic, followed by supply chain and economic issues, we are forecasting significant increases in 2024 for local TV advertising,” said Buono. “Continuous examination and foresight will be key to maintaining a strong position.”

Share of Wallet: Performance Benchmarking

To help television executives stay on top in a changing advertising marketplace, BIA is ready to perform a Share of Wallet (Sow): Performance Benchmarking Analysis that is customized to a broadcast group. Email customservice@bia.com for details.

U.S. Local Advertising Forecast

BIA has issued an update to its U.S. Local Advertising Forecast for 16 media, including local broadcast television, and 96 business sub-verticals. The five-year forecast is available for all 210 local television markets and is based on a proprietary forecasting methodology of the local advertising marketplace. The forecast can be purchased here and also accessed by subscription to BIA ADVantage, BIA’s local advertising intelligence platform. For subscription details, email sales@bia.com.

About BIA Advisory Services

BIA Advisory Services is the leading authority for data-centered insights, analysis, strategic consulting, and valuation services for the local media industry. Since 1983, BIA has been a valuable resource for traditional and digital media companies, brands and agencies, the financial and legal community serving media and telecom, as well as the FCC and other government agencies. Today, we offer comprehensive local market advertising intelligence in our BIA ADVantageTM service to help clients discover the path to their best opportunities. Learn more about our offerings at http://www.bia.com.