BIA/Kelsey Bytes are excerpts from research reports. This is the latest installment from the recently launched report, Call Commerce: A $1 Trillion Economic Engine. It picks up where last week’s post left off.

The report can be downloaded for free here.

Market Sizing: Call Analytics in Search

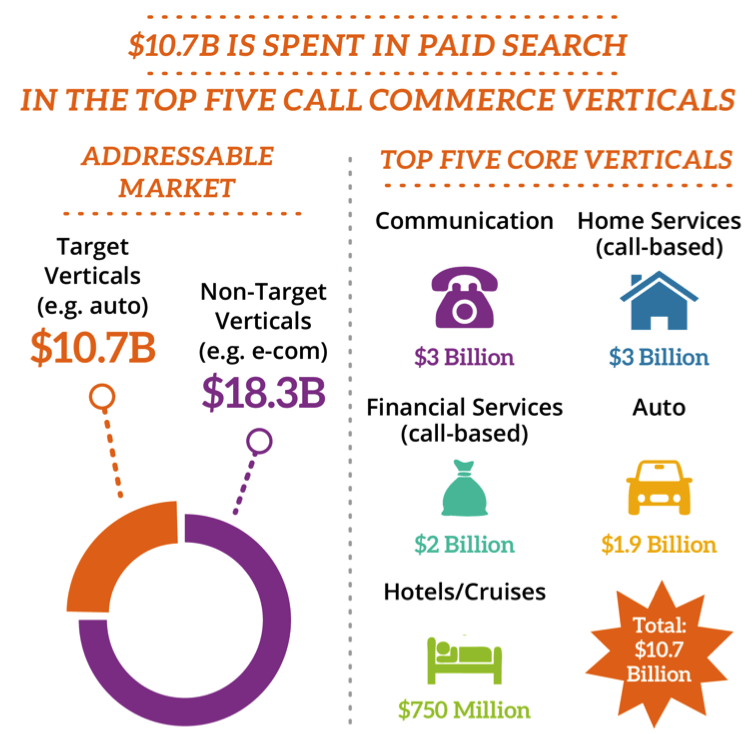

A question that emerges based on this discussion is, what is the size of the market opportunity in call analytics? One way to gauge the addressable market is to look within search advertising. As mentioned, search is a leading category of click-to-call activity and, by extension, call analytics.

Examining search is just one proxy for sizing the call analytics market opportunity, but is still a useful exercise in beginning to get a sense of its scale. To be fair, call commerce increasingly applies to an array of mobile formats and touch points such as social, display, and messaging.

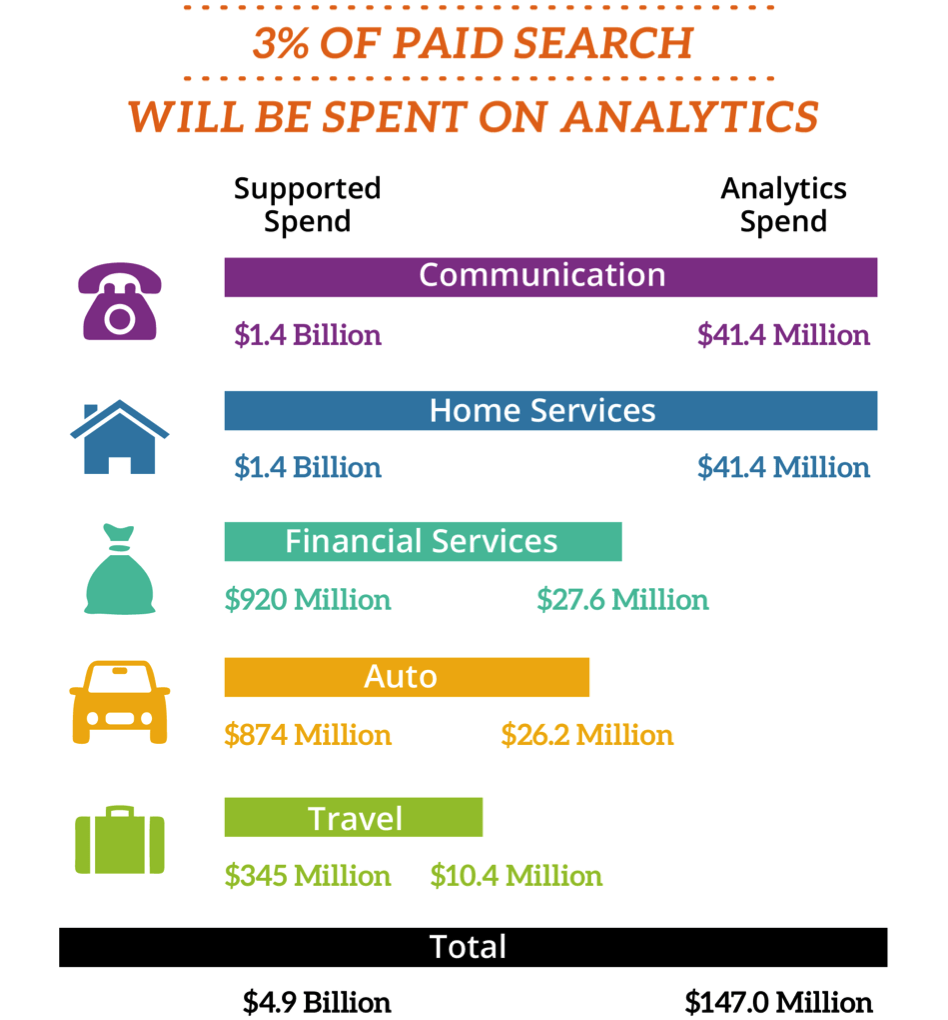

Within the top call-centric verticals examined below, search ad spend is almost $11 billion. From there, BIA/Kelsey estimates with the help of Marchex (see disclosure) that addressable revenues for call commerce are equal to three percent of that spend, which amounts to almost $150 million.

It’s important to note this is the addressable market, not current spending. It’s also limited to the top five call-centric categories where most call analytics happens. Again, it’s just within search. This addressable market will grow as the application of call analytics itself grows.