Top business categories driving industry revenue include auto dealers, wireless telecommunications, hospitals and full-service restaurants

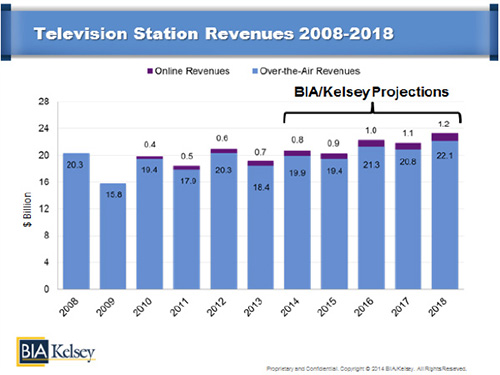

CHANTILLY, Va. (April 24, 2014) – BIA/Kelsey, adviser to companies in the local media industry, forecasts the local television advertising market will grow by nearly eight percent in 2014, after dipping in 2013. According to its first edition of the quarterly Investing In Television® Market Report, the firm reports that last year the industry earned $700 million in online revenues and $18.4 billion in over-the-air revenues, an 8.5 percent drop from 2012, which was an exceptional year for political advertising. For 2014, BIA/Kelsey anticipates combined local TV revenues (over-the-air and digital) to reach $20.7 billion in 2014.

“This year there will be a significant uptick in ad revenues driven by political ads in hotly contested states,” said Mark Fratrik, senior vice president and chief economist, BIA/Kelsey. “Additionally, we’re seeing the ability of local stations to maintain their loyal advertiser base, which means they consistently receive recurring ad revenue that boosts their profitability.”

The top four business category sources of revenue for local television in 2013, according to BIA/Kelsey’s Media Ad View Plus Forecast, were automotive dealers ($3.5 billion), wireless telecommunications ($772 million), hospitals ($652.7 million), and full-service restaurants ($558.3 million). While these are the four largest business categories utilizing local television, the number of different types of businesses utilizing local TV stations is wide. “The continued use of local television stations in their advertising mix, even in the face of tremendous competition for both viewers and advertisers, suggests a strength in the local television industry,” according to Fratrik.

The chart below represents BIA/Kelsey’s forecast for the television industry broken down by over-the-air and online:

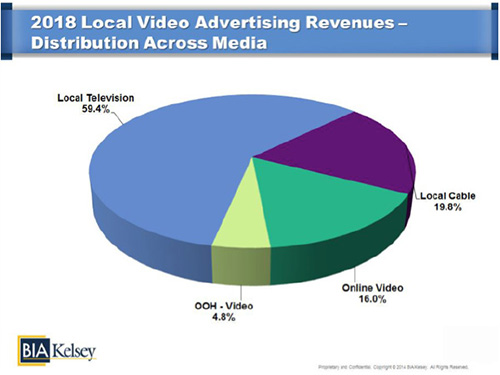

Despite its current position, the television industry is experiencing competition from video media solutions. Over the next five years, for instance, online video will experience a strong annual growth rate of 31.5 percent and out-of-home video will grow 9.2 percent. As a result of these changes, local television’s share of local video in 2018 will decrease from 67.5% in 2013 to 59.4% in 2018, even with the higher total revenues shown above ($22.1 billion in over the air revenues).

“To defend against the competition, local stations must become more sophisticated with the services they offer advertisers,” said Rick Ducey, managing director of BIA/Kelsey. “To get a valuable leg up on the other platforms they compete against, television stations are in the perfect position to deliver full-service digital agency services to local clients. As we work to help our clients build out their online offers, to include local online video options, we are seeing the effort net a valuable payoff.”

Investing In Television®

A comprehensive profile of all 210 television markets (plus Puerto Rico) and television market projections through 2018 are available in the first-quarter edition of Investing In Television® Market Report and the 2014 Investing In Television® Ownership Report, published by BIA/Kelsey. These reports can be purchased in print form or as a digital book.

Information in the Investing In books is also available in Media Access Pro™, a data and analytical service that delivers comprehensive information on the radio, television and newspaper industries.

Individual on-demand television market reports are also available with station competitive and performance information, including estimated advertising revenues, technical data, ownership and acquisition information, and more.

Media Ad View Plus

Covering 12 media, 12 ad categories and 94 business categories, BIA/Kelsey’s Media Ad View Plus Forecast tracks local advertising spending by media for the most recent year and for five years out (2012-2018) for every local market. Markets are organized by the 362 Core Based Statistical Areas (CBSAs) or TV/Radio markets.

For more information on BIA/Kelsey’s Investing In publications or Media Ad View reports, call (800) 331-5086 or email info@biakelsey.com.

About BIA/Kelsey

BIA/Kelsey advises companies in the local media space through consulting and valuation services, research and forecasts, Custom Advisory Services and conferences. Since 1983 BIA/Kelsey has been a resource to the media, mobile advertising, telecommunications, Yellow Pages and electronic directory markets, as well as to government agencies, law firms and investment companies looking to understand trends and revenue drivers. BIA/Kelsey’s annual conferences draw executives from across industries seeking expert guidance on how companies are finding innovative ways to grow. Additional information is available at https://www.bia.com, on the company’s Local Media Watch blog, Twitter (http://twitter.com/BIAKelsey) and Facebook (http://www.facebook.com/biakelsey). Stay connected by subscribing to the firm’s bi-monthly newsletter.

For more information contact:

Eileen Pacheco

For BIA/Kelsey

(508) 888-7478

eileen@tango-group.com

Robert Udowitz

For BIA/Kelsey

(703) 621-8060

rudowitz@biakelsey.com