Retail SMBs Nurturing Customer Relationships with Range of Digital Tools

New report, “Retail SMBs – Advertising & Marketing Trends,” highlights use of digital customer lists, CRM, loyalty programs, social media and mobile platforms for customer engagement and retention

CHANTILLY, Va. (June 1, 2015) – Retail SMBs (small and medium-sized businesses in the retail vertical industry segment) are highly oriented toward digital media, according to a new report by BIA/Kelsey titled, “Retail SMBs – Advertising & Marketing Trends.” Retail SMBs surveyed reported they planned to spend 43 percent of their total ad budget on digital media in the 12 months following the survey. This puts retail SMBs at the same high level of digital allocation as franchise SMBs, which reported plans to spend 42.9 percent of total ad budget on digital.

The report, which is based on data from BIA/Kelsey’s Local Commerce Monitor™ survey, explores the marketing and promotion spending behavior, advertising preferences and future marketing plans of retail SMBs (retail shops, stores and hair salons).

Retail SMB Marketing Priorities

SMBs in the retail vertical ranked social media marketing, SEM/SEO and email marketing as their top priorities for advertising and promotion in the 12 months following the survey.

“Going forward, retail SMBs register an interest in many advertising and marketing services, particularly ecommerce services, online satisfaction surveys, email marketing, online leads management and business software in general,” said Steve Marshall, director of research, BIA/Kelsey. “We believe this is consistent with their solid base in email marketing – they’ve got the foundation in place, and now they’re ready to add more sophisticated and powerful services.”

Mobile is increasingly important to these SMBs. Although they’re using mobile only in modest numbers so far (with the highest penetration of any mobile format at 11.4 percent), overall they report they’re very happy with the performance of mobile.

“The high level of satisfaction suggests that retail SMBs will greatly expand their use of mobile going forward,” added Marshall.

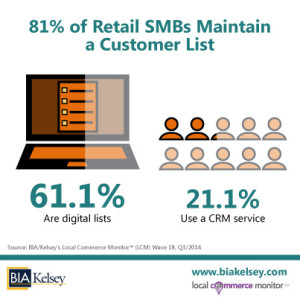

Customer Lists & CRM

The report reveals that retail SMBs are highly invested in maintaining customer lists, with 71.1 percent reporting they have maintained a customer list for over a year and 61.1 percent indicating they maintain their lists in electronic form. BIA/Kelsey analysts suggest this bodes well as a foundation for various marketing automation services such as CRM, currently used by 21.1 percent of those surveyed.

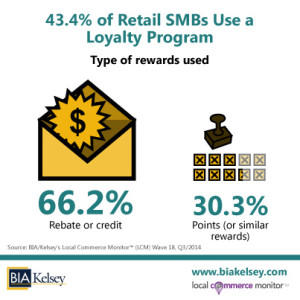

Customer Loyalty Programs

Retail SMBs expect 34.7 percent of their total business will be transacted via sales or other promotions in the 12 months following the survey, many of which are tied to loyalty programs. Among those surveyed, 43.4 percent of retail SMBs currently have a loyalty program and another 22 percent said they are likely to add one in the 12 months following the survey. Among those with loyalty programs, a rebate or credit is the most widely used type of reward, used by 65.2 percent of retail SMBs.

Get the Report: “Retail SMBs – Advertising & Marketing Trends”

The Local Commerce Monitor report, “Retail SMBs – Advertising & Marketing Trends” may be purchased online: https://shop.biakelsey.com/product/retail-smbs-lcm-wave-18. BIA/Kelsey advisory service clients who have portal access can download the report in the client portal.

Those who would benefit from reading this report include: executives in charge of marketing and/or product development targeted to SMBs in any retail business; senior leaders evaluating opportunities in the SMB marketplace; any executive with a role in selling digital or social media products; and anyone focused on the trends and direction of retail SMBs.

The trends identified in this report will be among those shaping the program for this fall’s BIA/Kelsey SMB conference, which takes place Sept. 29-30, in Denver. Information about the conference is available at https://www.bia.com/SMB.

About Local Commerce Monitor™

Local Commerce Monitor (LCM) is BIA/Kelsey’s ongoing tracking survey of small and medium-sized businesses conducted online with research partner Ipsos. The survey measures where SMBs are spending their advertising and promotional budgets and how their media usage and spending habits are evolving.

For this study, SMB is defined as a business having from 1 to 99 employees. Local Commerce Monitor draws its sample of business respondents from a mix of nationally scoped MSAs, primarily based on first- and second-tier markets. Local Commerce Monitor Wave 18 was conducted in July 2014 via an online survey of 546 SMBs. The data regarding retail SMBs is based on the responses of 76 respondents who reported that their primary business activity falls in the retail vertical (retail shops and stores, hair salons, beauty salons and barber shops). Retail shops or stores make up 91.5 percent of this group, and hair salons, beauty salons and barber shops make up the remaining 8.5 percent. Salons are included in the retail vertical due to the significant portion of their net sales that is generated from sales of hair products. The LCM Wave 18 findings have been weighted to reflect the incidence of SMBs by size bracket, according to the SMB size bracket data provided by the U.S. Bureau of the Census.

About BIA/Kelsey

BIA/Kelsey advises companies in the local media space through consulting and valuation services, research and forecasts, Custom Advisory Services and conferences. Since 1983 BIA/Kelsey has been a resource to the media, mobile advertising, telecommunications, Yellow Pages and electronic directory markets, as well as to government agencies, law firms and investment companies looking to understand trends and revenue drivers. BIA/Kelsey’s annual conferences draw executives from across industries seeking expert guidance on how companies are finding innovative ways to grow. Additional information is available at https://www.bia.com, on the company’s Local Media Watch blog, Twitter (http://twitter.com/BIAKelsey) and Facebook (http://www.facebook.com/biakelsey). Stay connected by subscribing to the firm’s bi-monthly newsletter.

For more information contact:

Eileen Pacheco

For BIA/Kelsey

(508) 888-7478

eileen@tango-group.com